Bigger Properties.

Bigger Profits.

‘If you cannot see where you are going, ask someone who has been there before.’

J Loren Norris

Why Choose This Approach?

Unlock the potential of large-scale property investments with blocks of flats and large HMOs to accelerate your financial freedom.

Investing in property has long been a reliable path to financial freedom. By focusing on larger projects, you can fast-track your investment goals and maximise returns without increasing your workload.

Our mentoring program is designed for investors looking to make their first significant property purchase. Ready to achieve your goals faster by scaling up your investment strategy? Get ready to go where the air is thinner.

Why Elevate Property Mentoring?

Our team comprises multi-award-winning property experts specialising in blocks of flats and large HMOs. With a proven track record, we’ll guide you through acquiring your first major property investment, offering the expertise and support to help achieve your goals.

“The best way to predict your future is to create it with the help of a mentor”

Peter Drucker

The Standard

– what most investors do

6-Bed HMO, Sheffield

Purchase Price

£325k

Total money in (Purchase costs + Refurb)

£250k

Gross Development Value (GDV)

£550k

Money Left In On Refinance

£97.5k

Annual Profit (income minus interest and costs)

£9.6k

Return on Capital Employed (ROCE)

10%

These examples above highlight the efficiency of larger deals. Purchasing three standard 6-bed HMOs, a realistic target for many investors, would yield £2,400 per month in profit. However, managing three separate acquisitions, refurbishments, and refinances comes with significant effort.

Alternatively, by investing the same amount in one larger project, you could achieve 7.5 times the return with less administrative burden, undergoing the process just once.

The Challenges

Is it a Gamble or a Risk?

Worried about venturing into larger property deals because it feels like too much of a gamble? You’re not alone. The reality is, with the right guidance, this can be a calculated and rewarding move.

Here and Now vs

Why did you start investing in property? Most people do it to create a better life, whether that’s earning more money or having more free time. If your current strategy isn’t bringing you closer to those goals, it’s time to reconsider your approach.

What Got You Here Won’t Get You There

Doing the same thing over and over again and expecting a different result is one definition of insanity. Bigger opportunities require a change in mindset, but they also offer the potential for significantly greater rewards.

I Don’t Have the Time…

Do you find yourself constantly firefighting in your business? Managing tenants, responding to endless emails, and handling every issue yourself? If you’re always available, you’re limiting your ability to grow. Investing in larger deals could give you the breathing space you need.

Too Much Competition

The market is crowded with people chasing the same small properties—single lets, 4-6 bed HMOs, rent-to-rent schemes, and lease options. Trying to secure a good deal among this noise can feel overwhelming. Scaling up to larger investments not only offers better returns but also removes you from the most crowded spaces in the market.

The Solutions

Take Only Calculated Risks

No investment is entirely risk-free, but you can minimise those risks by tapping into our expertise and experience. With the right knowledge, larger property deals become a strategic move, not a gamble.

… Over There and Now

The life you aspire to is often just a deal away. Investing in a larger property with higher profit margins could be the step that takes you from where you are now to the lifestyle you’ve been working towards.

Decide to Do Something Different

Following the crowd might feel safer, but it rarely leads to extraordinary results. Real growth comes from doing what others won’t. Choose to break away from the norm and seize bigger opportunities that offer far greater rewards.

Leverage Other People’s Time and Skills

It’s easy to think no one can manage things as well as you, but, staying hands-on keeps you stuck. To scale up, you need to start valuing your time more. Streamline your investments by systemising processes and delegating tasks that aren’t high-value. Work on your business, not in it.

Go Where The Air Is Thinner

Larger deals attract far less competition. This means there’s often more room for negotiation and greater profit potential. While the majority are scrambling for small properties, set yourself apart by pursuing bigger deals where the returns are higher and the competition is lower.

The Challenges & Solutions

Is it a Gamble or a Risk?

Worried about venturing into larger property deals because it feels like too much of a gamble? You’re not alone. The reality is, with the right guidance, this can be a calculated and rewarding move.

Take Only Calculated Risks

No investment is entirely risk-free, but you can minimise those risks by tapping into our expertise and experience. With the right knowledge, larger property deals become a strategic move, not a gamble.

Here and Now vs

Why did you start investing in property? Most people do it to create a better life, whether that’s earning more money or having more free time. If your current strategy isn’t bringing you closer to those goals, it’s time to reconsider your approach.

… Over There and Now

The life you aspire to is often just a deal away. Investing in a larger property with higher profit margins could be the step that takes you from where you are now to the lifestyle you’ve been working towards.

What Got You Here Won’t Get You There

Doing the same thing over and over again and expecting a different result is one definition of insanity. Bigger opportunities require a change in mindset, but they also offer the potential for significantly greater rewards.

Decide to Do Something Different

Following the crowd might feel safer, but it rarely leads to extraordinary results. Real growth comes from doing what others won’t. Choose to break away from the norm and seize bigger opportunities that offer far greater rewards.

I Don’t Have the Time…

Do you find yourself constantly firefighting in your business? Managing tenants, responding to endless emails, and handling every issue yourself? If you’re always available, you’re limiting your ability to grow. Investing in larger deals could give you the breathing space you need.

Leverage Other People’s Time and Skills

It’s easy to think no one can manage things as well as you, but, staying hands-on keeps you stuck. To scale up, you need to start valuing your time more. Streamline your investments by systemising processes and delegating tasks that aren’t high-value. Work on your business, not in it.

Too Much Competition

The market is crowded with people chasing the same small properties—single lets, 4-6 bed HMOs, rent-to-rent schemes, and lease options. Trying to secure a good deal among this noise can feel overwhelming. Scaling up to larger investments not only offers better returns but also removes you from the most crowded spaces in the market.

Go Where The Air Is Thinner

Larger deals attract far less competition. This means there’s often more room for negotiation and greater profit potential. While the majority are scrambling for small properties, set yourself apart by pursuing bigger deals where the returns are higher and the competition is lower.

Our Packages

|

|

Most popular

|

|

|

Gold6+ months |

Platinum6+ months |

Platinum+6+ months |

|

|

£

445

/mo

|

£

695

/mo

|

£

1,095

/mo

|

|

| 1x 45 min video call per month | |||

| Initial in-depth strategy session, including a comprehensive assessment of the current investment strategy. | |||

| Deal appraisal and analysis, with ongoing guidance to secure your first large property investment. | |||

| Email support | |||

| Monthly goal setting and accountability | |||

| Access to the Wealth Dynamics profiling tool for entrepreneurs. | |||

| 2 x 45-minute video calls per month. | |||

| Two free places to attend one open day at our current project. | |||

| Followed by a face-to-face meeting (replacing one virtual call). | |||

| Access to the resource library, including templates, assets and processes | |||

| Sharing of Black Book (our network, solicitors, brokers, investors). | |||

| Evaluation of: Costed schedule of works Rental management Exit strategies | |||

| Case Study Examples: Real-life examples of successful large-property investments for inspiration. | |||

| SOS support call | |||

| Unlimited whatsapp support from Chris & Richie | |||

| Unlimited video calls | |||

| Bespoke templates, guides and processes for deal analysis and running your business tailored to your specific needs | |||

| Advanced deal appraisal and analysis with ongoing expert guidance | |||

| Priority email support | |||

| Comprehensive action plan and strategy development | |||

| Annual strategy planning session |

Gold

6+ months-

1x 45 min video call per month

-

Initial in-depth strategy session, including a comprehensive assessment of the current investment strategy.

-

Deal appraisal and analysis, with ongoing guidance to secure your first large property investment.

-

Email support

-

Monthly goal setting and accountability

-

Access to the Wealth Dynamics profiling tool for entrepreneurs.

Platinum

6+ months-

Same features as our Gold Package

-

2 x 45-minute video calls per month.

-

Two free places to attend one open day at our current project.

-

Followed by a face-to-face meeting (replacing one virtual call).

-

Access to the resource library, including templates, assets and processes

-

Sharing of Black Book (our network, solicitors, brokers, investors).

-

Evaluation of: Costed schedule of works, Rental management, Exit strategies

-

Case Study Examples: Real-life examples of successful large-property investments for inspiration.

-

SOS support call

Platinum+

6+ months-

Same features as our Platinum Package

-

Unlimited whatsapp support from Chris & Richie

-

Unlimited video calls

-

Bespoke templates, guides and processes for deal analysis and running your business tailored to your specific needs

-

Advanced deal appraisal and analysis with ongoing expert guidance

-

Priority email support

-

Comprehensive action plan and strategy development

-

Annual strategy planning session

One off call

£295 - 60 mins

Save 5% when you pay for 6 months upfront

Save 10% when you pay for 12 months upfront

“Mentoring is a brain to pick, an ear to listen, and a push in the right direction.”

John C Crosby

Book Your Free Bigger Deal Strategy Call Today!

Start by filling out our Bigger Deal Strategy questionnaire to pinpoint your current position and future goals – nothing is left to chance. Then, join us for a complimentary 45-minute Bigger Deal Strategy Call where you can ask questions and gain valuable insights tailored to your plan.

Let’s help you find, buy, and close on your first large property within 12 months!

Warning

This isn’t for beginners. If you’re just starting out in property investment, this program isn’t the right fit. Our mentoring is for experienced investors ready to take their portfolio to the next level, focusing on fewer but more profitable deals. If we believe we’re not the best match for your needs, we’ll gladly refer you to someone who is.

Sponsored by

“My mentor said “let’s go do it,” not “you go do it.” How powerful when someone says, “let’s”.

Jim Rohn

Testimonials

“You can't be, what you can't see”

Damian Hughes

“We were initially unsure about taking on larger property investments, but Chris’ expertise and support have been invaluable. His knowledge and clear direction have helped us expand our portfolio in ways we never thought possible.”

Hassan – London

“Richie has been such a helpful source of knowledge combined with experience to my wife and I as we started out in business. His wealth of information and practical tips have been critical to our start up, as well as managing our own personal finances. Richie is a gem we are so grateful to have found. “

Adam – S Devon

“I own a portfolio of 24 HMOs in Huddersfield and frequently turn to Richie for advice. His extensive knowledge of the property sector is invaluable. Richie excels at solving complex problems, drawing on his experience and network to find solutions. He’s a great listener and always explains things in a way that’s easy to grasp. He’s also taken on projects that most people wouldn’t even consider. On top of that, he’s genuinely a nice guy!”

Ashley – Huddersfield

“Richie’s guidance has been transformative. His approach gave me the confidence to pursue bigger projects, and his strategies have taken my property investments to new heights.”

Helen – Chippenham

“Collaborating with Chris has completely elevated my property investment journey. His extensive experience and deep industry knowledge have provided me with essential insights into securing finance and maximising returns. Chris’s integrity and reliability are second to none, and his open-minded approach, combined with a steady flow of fresh ideas, has been key to refining my strategies and driving a significant boost in my profits.”

Brandon – N Devon

“Richie has a keen instinct for spotting profitable property deals, combined with the expertise to build strong business plans. He’s always the first person I turn to when I’m considering a new investment.”

Jason – Bristol

“Richie has been incredibly helpful with his time and advice. His insights into growing and scaling my business have streamlined my operations, freeing up time for daily tasks. His book suggestions on personal and business growth were also a fantastic bonus. Thank you, Richie!”

Ashleigh – Bradford

Meet Your Mentors

Chris and Richie formed their partnership in 2019 and quickly gained recognition as trailblazers in the property sector. They became the first-ever multiple Deal of the Year winners at Property Entrepreneur, with awards in both 2021 and 2024, and achieved Level 4 accreditation in Daniel Hill’s prestigious Property Entrepreneur programme. Since 2021, they have mentored property investors, sharing their expertise and proven strategies. In addition to their property success, they founded and scaled an award-winning self-storage business. In 2024, they joined Josh Keegan’s Ultimate FD Mastermind group. Using none of their own money, they’ve successfully bought, refurbished, and refinanced blocks of flats and a mega HMO.

Chris Chadwick

- Started, scaled and moved out of day to day running of a multi award winning lettings agency

- Financial freedom achieved and relocated family from Sheffield to his dream home in Devon after refurbishing a derelict farm house

- Renovated and refurbed over 100 properties

- Owns 50+ properties

- Flipped £millions of property

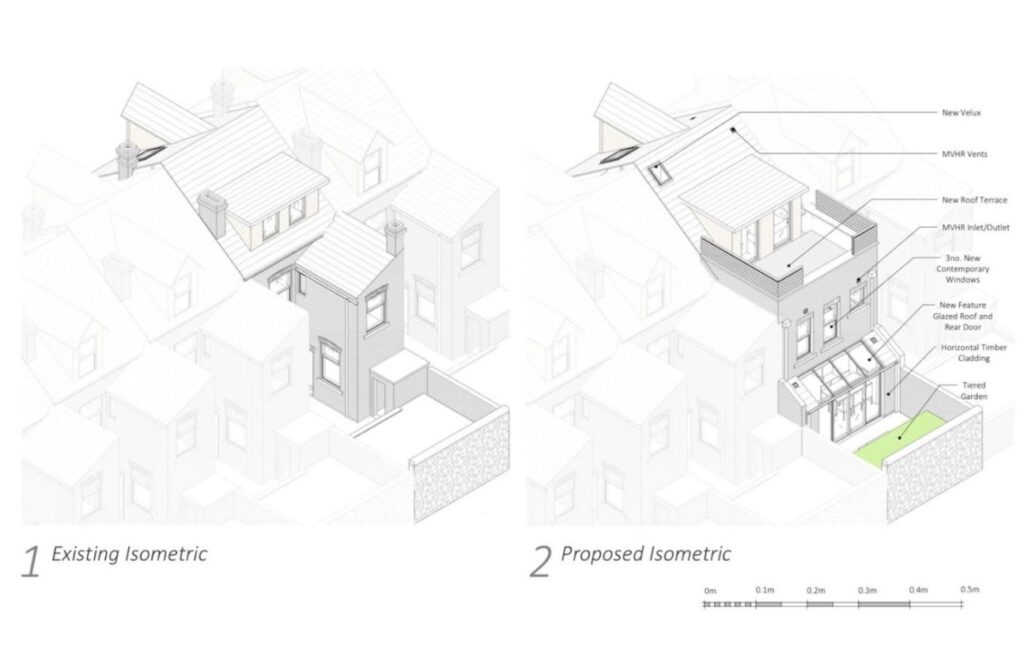

- Property investor and developer with 20+ yrs experience; worked with commercial to residential conversions, HMO conversions, holiday lets, barn conversions, commercial refurbs, extensions and new builds – all his own properties

- £10m portfolio

- Inducted into Property Entrepreneur Hall of Fame

- Former property columnist for a regional magazine

- Husband, father to two girls, 3 dogs, a cat, chickens and ducks. Loves the outdoors.

Richie Miller

- Army Veteran, formally a Major with the Royal Logistic Corps

- Financial freedom achieved

- Coach for Simon Zutshi’s Mastermind Program

- Simon Zutshi Mastermind Graduate

- Regular case study for Simon Zutshi HMO Mastery Course

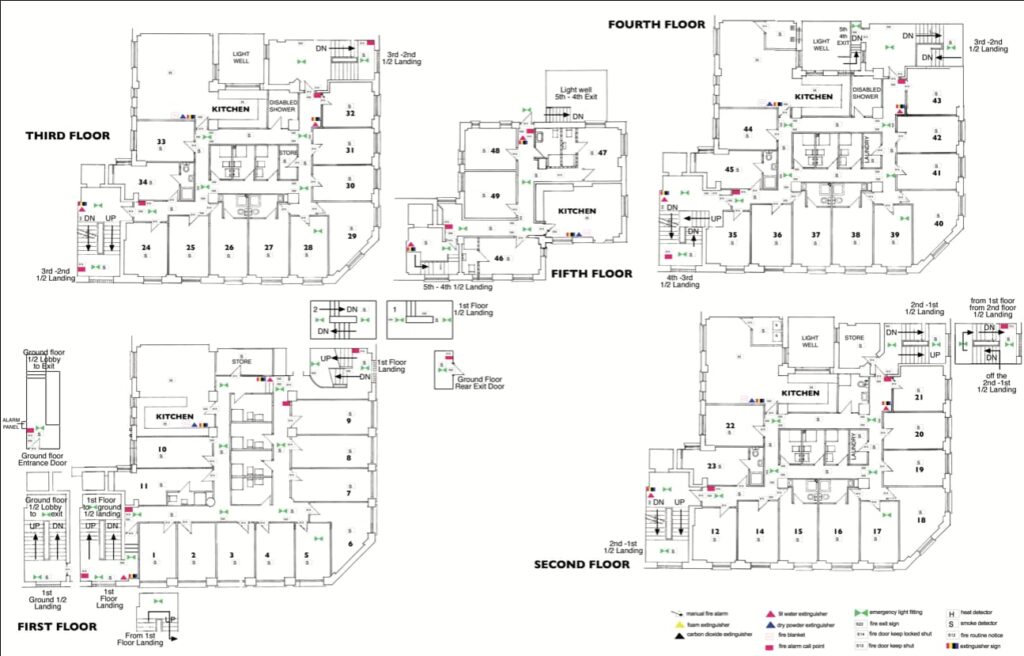

- Mega 48 bed HMO bought with none of his own money and no money left in

- Block of 16 flats bought with vendor finance

- Former PIN speaker and host

- £5m portfolio

- <20 hr working week, highly systemised businesses

- Award winning landlord

- Inducted into Property Entrepreneur Hall of Fame

- As featured on Blueprint podcast (Hall of Fame & Deals Deals Deals); Tej Talks and Property Investing 2.0 with Raj Chengadu.

- As featured in YPN Magazine

- Husband, father to two boys who we home educate. Loves skiing, travelling and fitness. Barefoot shoe enthusiast.

“Mentoring should be a fulfilling relationship between somebody with more experience and somebody with less, with the goal of helping both individuals become elevated versions of themselves.”

Janice Omadeke

Book your Bigger Deal Strategy Call

Please complete our Bigger Deal Strategy questionnaire prior to your appointment!

This will ensure that we have a better understanding of your current experience and what future goals you would like to achieve.